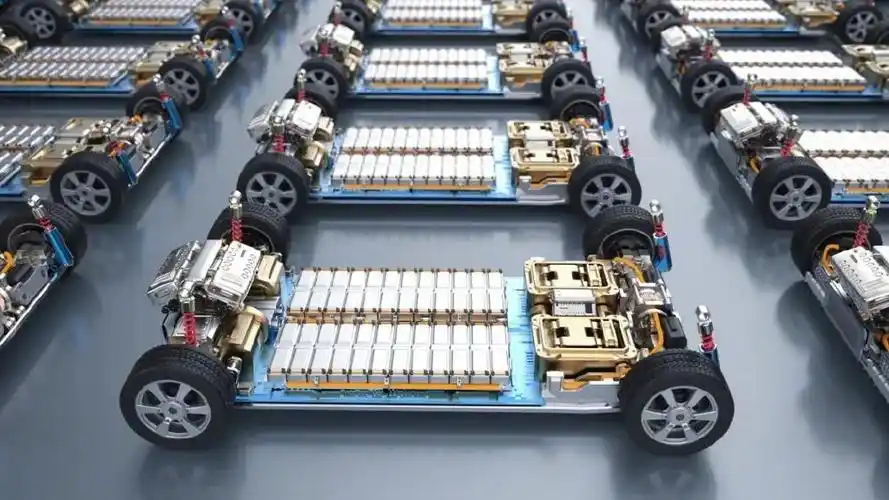

China has effectively capitalized on the unique qualities of lithium iron phosphate (LiFePO4) batteries, especially through the use of stacked sheet technology in long and short blade designs, maximizing their volumetric energy density. After a relatively quiet period for lithium iron phosphate before 2017, its growth has surged again, continuing strongly into 2022.

In 2021, LiFePO4 battery production achieved a significant lead over lithium NMC (nickel manganese cobalt) batteries. Considering the cost structure, LiFePO4 is likely to maintain a substantial competitive edge domestically. In passenger vehicles, the market share for LiFePO4 may increase from about 45% to as much as 70%. This suggests that LiFePO4 batteries will power vehicles with ranges under 600 kilometers, with installations for A00-level vehicles steadily increasing. In terms of total market penetration, LiFePO4 batteries could make up 75% to even 80% of installations.

LiFePO4 vs. NMC Batteries Across Applications

In November, LiFePO4 battery installations in passenger vehicles reached 7.99 GWh, powering 217,400 units. By comparison, NMC batteries had an installed capacity of 9.8 GWh for 190,000 vehicles. Since August, LiFePO4 has overtaken NMC in the number of units installed, with Wh capacity surpassing NMC in September before fluctuating slightly, mainly due to Tesla’s domestic and export variations. Overall, LiFePO4 batteries in China have now surpassed ternary lithium batteries in vehicle applications.