It is commendable that China is leveraging the unique advantages of lithium iron phosphate (LFP) batteries, particularly through the use of stacked sheet technology in long and short blade designs. This approach maximizes the volumetric energy density, building on the momentum gained since the resurgence of LFP batteries post-2017, which continues to gain traction in 2022.

In 2021, LFP batteries achieved a significant milestone by surpassing lithium NMC batteries in production volume. Given the overall cost structure, LFP batteries are expected to maintain a dominant position in the domestic market. Their adoption in passenger vehicles is projected to rise from the current 45% to around 70%. This means LFP batteries will likely power vehicles with ranges below 600 kilometers, with the A00 segment seeing a steady increase in installations. In terms of absolute numbers, LFP-powered vehicles could account for 75% to 80% of the market.

Applications of LFP and NMC Batteries in Different Fields

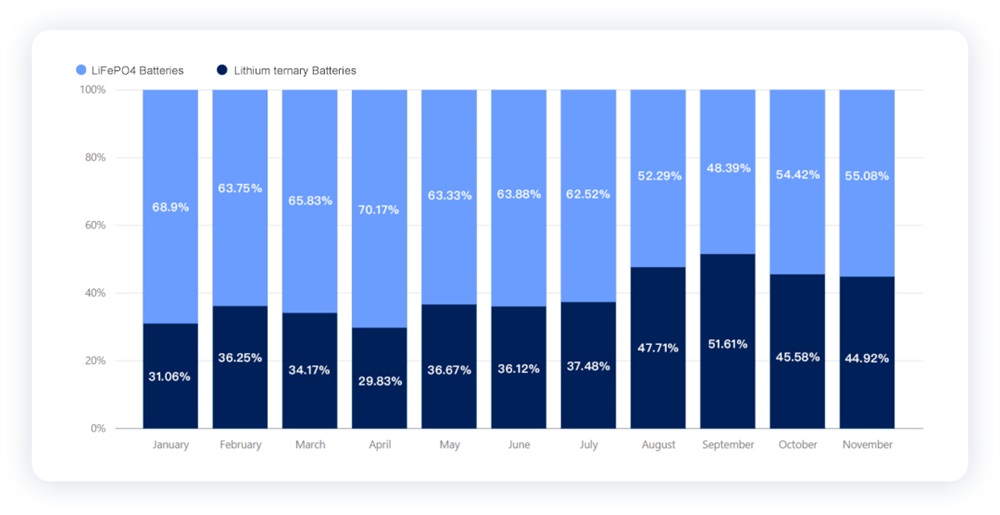

In November, LFP batteries demonstrated their growing dominance in passenger vehicles, with installations reaching 7.99 GWh across 217,400 vehicles. In comparison, ternary (NMC) batteries recorded 9.8 GWh of installations in 190,000 vehicles. While LFP surpassed NMC in the number of installations in August, it briefly overtook NMC in energy capacity (GWh) in September before fluctuating due to factors like Tesla’s domestic production and export dynamics. Nonetheless, LFP batteries have effectively surpassed ternary lithium batteries in terms of application within China’s automotive sector.